Teams | Collaboration | Customer Service | Project Management

Analytics

10 business intelligence tools for small businesses

Think business intelligence (BI) is only for the big guys? Not anymore. In the past, business intelligence software was expensive and effectively limited to big businesses. Integrating it into existing systems (let alone running it) required more resources and IT infrastructure than the typical small to mid-sized professional service firms could muster.

How workforce analytics can boost contact center efficiency

Insightful Tools for Insightful Leaders: Enhancing Remote Work with Performance Analytics

Explore the benefits of performance analytics tools for remote work and learn how to become an insightful leader that knows how to monitor pc activity without being creepy. Discover the best options for managers and remote employees to optimize productivity and engagement.

How to increase productivity with workday analytics and insights

Increasing productivity improves cost efficiency. The more productive your people are, and the more repeatable the processes underpinning that productivity, the more costs stay under control while revenue rises. This is because ‘productivity’ is greater than the sum of its parts – those parts being broadly categorized into ‘people’ and ‘performance’.

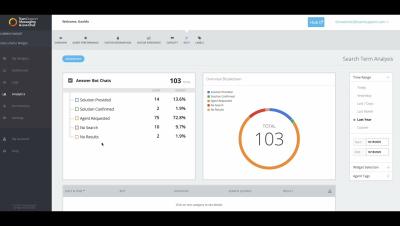

Understand the power of Answer Bot Analytics

Leveraging Advanced Analytics to Transform Insurance Customer Experience

Insurance industry is witnessing a significant transformation driven by advanced analytics. And with an increasing number of customers seeking personalized services and seamless experiences, insurers are under pressure to adapt. A recent study reveals that 68% of insurance customers expect their providers to offer tailored solutions, while 89% believe a smooth customer experience is crucial. Staying in sync with the transformation is a must for businesses in the insurance sector.

How InvGate Uses InvGate Insight

11 best call center analytics software to assess performance

Building a successful call center requires ongoing efforts to track agent performance, improve call times, and increase customer satisfaction. If you’ve tried monitoring these metrics with spreadsheets or other manual methods, you probably found them to be inefficient at best and inaccurate at worst. With call center analytics software, you can efficiently track the metrics that matter to your team.